WHAT IS ‘UNSYSTEMATIC RISK?’

Unsystematic risk is one of a kind to a particular organization or industry. Also called as “nonsystematic risk,” “particular risk,” “diversifiable risk” or “lingering risk,” with regards to a venture portfolio, unsystematic risk can be decreased through broadening.

Unsystematic hazard can be depicted as the vulnerability characteristic in an organization or industry venture. Sorts of unsystematic hazard incorporate another rival in the commercial center with the possibility to take critical piece of the pie from the organization put resources into, an administrative change (which could drive down organization deals), a move in administration, as well as an item review.

While speculators might have the capacity to envision a few wellsprings of unsystematic hazard, it is difficult to know all or when/how these might happen. For instance, a financial specialist in medicinal services stocks might know that a noteworthy move in wellbeing approach is not too far off, yet she/he can’t know ahead of time the particulars of the new laws and how organizations and shoppers will react. The continuous appropriation and afterward potential annulment of the Affordable Care Act, first composed into law in 2010, has made it extremely trying for a few speculators in human services stocks to envision and put down certain wagers on the course of the business as well as particular organizations.

UNSYSTEMATIC RISK EXAMPLES

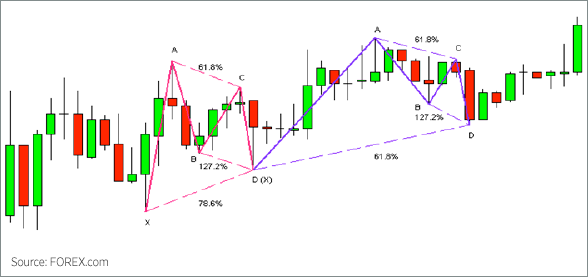

By owning an assortment of organization stocks crosswise over various businesses, and also by owning different kinds of securities in an assortment of benefit classes, for example, Treasuries and city securities, speculators will be less influenced by single occasions. For instance, a financial specialist, who possessed only aircraft stocks, would confront an abnormal state of unsystematic hazard. She would be helpless if aircraft industry representatives chose to go on strike, for instance. This occasion could sink aircraft stock costs, even briefly. Essentially the expectation of this news could be heartbreaking for her portfolio.

By adding uncorrelated property to her portfolio, for example, stocks outside of the transportation business, this financial specialist would spread out air-travel-particular concerns. Unsystematic hazard for this situation influences particular aircrafts as well as a few of the ventures, for example, huge nourishment organizations, with which numerous carriers work together. In such manner, she could enhance far from open values through and through by including US Treasury Bonds as an extra insurance from changes in stock costs.

Indeed, even an arrangement of very much expanded resources can’t get away from all hazard, be that as it may. The portfolio will in any case be presented to orderly hazard, which alludes to the vulnerability that faces the market all in all and incorporates moves in loan costs, presidential decisions, monetary emergencies, wars, and cataclysmic events.