WHAT IS AVERAGE TRUE RANGE?

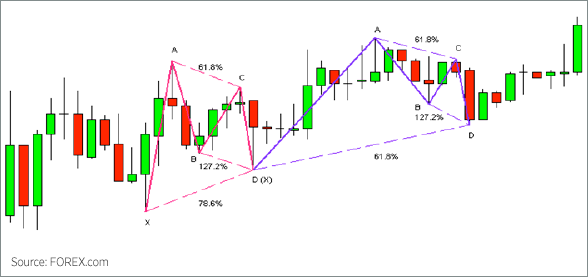

The Average True range (ATR) is a specialized examination marker that estimates unpredictability by breaking down the whole scope of a benefit-cost for that period. In particular, ATR is a proportion of unpredictability presented by Welles Wilder in his book, “New Concepts in Technical Trading Systems.” The genuine range pointer is the best of the accompanying: current high less the present low, the outright estimation of the present high less the past close and the total estimation of the present low less the past close. The normal genuine range is a moving normal, for the most part, 14 days, of the genuine extents.

SEPARATING AVERAGE TRUE RANGE

More out of control initially built up the normal genuine range (ATR) for wares, however, the marker can likewise be utilized for stocks and files. Basically, a stock encountering an abnormal state of unpredictability has a higher ATR, and a low instability stock has a lower ATR. The ATR might be utilized by advertising professionals to enter and leave exchanges, and it is a valuable instrument to add to an exchanging framework. It was made to enable merchants to all the more precisely measure the day by day instability of a benefit by utilizing basic figuring. The marker does not demonstrate the value bearing; rather it is utilized principally to quantify instability caused by holes and point of confinement up or down moves. The ATR is genuinely easy to compute and just needs recorded value information.

AVERAGE TRUE RANGE CALCULATION EXAMPLE

Brokers can utilize shorter periods to create additionally exchanging signals, while longer periods have a higher likelihood to produce less exchanging signals. For instance, accept fleeting merchant just wishes to examine the instability of a stock over a time of five exchanging days. In this manner, the merchant could compute the five-day ATR. Accepting the recorded value information is masterminded backwards sequential request, the broker finds the greatest of the outright estimation of the present high less the present low, total estimation of the present high short the past close and the supreme estimation of the present low less the past close. These counts of the genuine range have improved the situation the five latest exchanging days and are then arrived at the midpoint of to compute the main estimation of the five-day ATR.

EVALUATED AVERAGE TRUE RANGE CALCULATION

Accept the primary estimation of the five-day ATR is figured at 1.41 and the 6th day has a genuine scope of 1.09. The consecutive ATR esteem could be assessed by duplicating the past estimation of the ATR by the quantity of days less one, and after that including the genuine range for the present time frame to the item. Next, separate the total by the chose time allotment. For instance, the second estimation of the ATR is evaluated to be 1.35, or (1.41 * (5 – 1) + (1.09))/5. The equation could be rehashed over the whole day and age.

To learn more about Forex trading, click on www.learnforexanalysis.com. Get expert guidance from the experts of the industry.

Register with us and subscribe to SIBY VARGHESE’ FOREX PAMM services to earn steady profits.