What is the fundamental analysis in forex?

In the forex market or foreign exchange market or commonly called as fx, fundamental analysis basically looks to measure a company’s true value and to base investments upon this type of calculation. To some extent, the same is also done in the retail forex market, where all the forex fundamental traders evaluate and understand the value of forex trading currencies of their respective countries and how they work there, with other currencies across the globe while they are being traded by the traders, like different trading companies and how they use economic announcements to gain an idea of the currency’s true value, depending upon the market trend, is what fundamental analysis basically in forex is.

From all the driven analysis, economic data and political events that come out about a country happening all across are similar to the news that comes out about a stock in that it is used by investors to gain an idea of value. Now, this value changes over time due to many factors which certainly also depends upon bearish and bullish markets and other trends going in the market which overall includes the economic growth factors and financial strength as a part of fundamental analysis for all the fundamental traders who look at all of this information to evaluate a country’s currency.

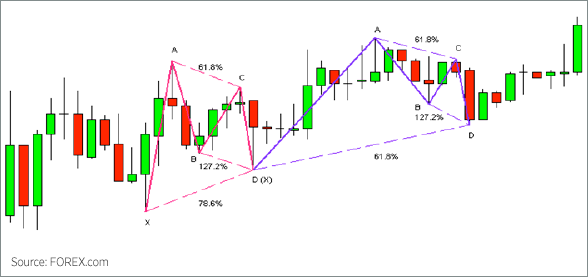

A forex market can break or make a trader depending upon the conclusions drawn from the results of fundamental analysis while trading, before trading and to know the final happening, after trading. A trader’s performance forms his own trading base and tells him if he is ready to trade. Given that there are practically unlimited forex fundamentals trading strategies based on fundamental data, one could write a book on this subject. To give you a better idea of a tangible trading opportunity, let’s go over one of the most well-known situations, the forex carry trade.

An example of fundamental analysis,

Say, you have 10 times leverage would create a return of 30% on a 3% yield. Now if you have $1,000 in your account and have access to 10 times leverage, you will be in control of $10,000. However, if you implement the currency carry trade from the example above, you will earn 3% per year. At the end of the year, your $10,000 investment would equal $10,300, or a $300 gain. Since you only invested $1,000 of your own money, your real return would be 30% ($300/$1,000). Now, this strategy only works if the currency pair’s value remains unchanged or appreciates, importantly. Therefore, most forex carry traders look not only to earn the interest rate differential, but also capital appreciation. While we’ve greatly simplified this transaction, the key thing to remember here is that a small difference in interest rates can result in huge gains when leverage is applied. Most of the currency brokers require at least a minimum margin to earn interest for carry trades, also advised by the Top Forex Traders.

It is still a vast area to understand and learn, so if you are the keen one who thinks Forex trading is your thing and as early as possible you should be informed about how fundamental analysis works, therefore contact Mr Siby Varghese (Awarded – Best Young Asian Forex Trader) – the best in the forex trading industry.

With thanks! Valuable information!

With thanks! Valuable information!

I got what you mean, saved to fav, very decent site. http://learnforexanalysis.com

This is a impressive story. Thanks!