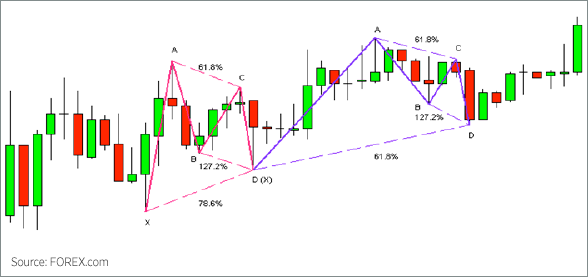

Data and experience are the principal parts in successful trading in any financial market. Some segment of having a solid base of trading data lies in knowing how generally they relate to and reacts against each other. Inter market examination is the examination of significant worth associations among different markets and how promoted costs could possibly be influenced along these lines.

While trading Bitcoin, merchants have discovered that its key associations with other overall cash related assets have tended to move after some time and are for the most part not as intense as other. For example, the strong reverse association between the US dollar and gold is both all-around detailed and reliable. The same generally can’t be said of the present relationship among Bitcoin and gold, or that of Bitcoin and any regular cash like the US dollar, euro, or yen.

In any case, possibly it is precisely Bitcoin’s typical attribute for low association with various markets that further lifts its appeal as a tradable asset. As most markets open for trading are related in some way or another with various markets, the ascent of an uncorrelated asset like Bitcoin gives a potential opportunity to separate trading and venture framework.

Information and experience are the main components in effective trading in any money related market. Some portion of having a strong base of trading information lies in knowing how markets, for the most part, relate with and responds against each other. The Intermarket examination is the investigation of value relationships among various markets and how market costs could conceivably be affected by this.

SAFE HAVEN POTENTIAL

While the relationships among Bitcoin and other budgetary resources are by and large neither significant nor persisting, we accept there is a high potential for Bitcoin to serve sooner or later as a noteworthy safe-haven resource like gold or the Japanese yen, yet maybe much more so.

Interest for a safe haven by and large increases forcefully amid times of market unrest, macroeconomic concern, or geopolitical hazard, as financial specialists look for the apparent well being of these advantages for support introduction to less secure resources like equities. As decentralized cryptocurrency, by definition, is completely separated from any single national bank, economy, government, or political gathering, Bitcoin has an undeniable potential to fill in as the quintessential safe-haven instrument. Meanwhile, Bitcoin presents many directional trading options in view of its regularly lifted instability and reliably uplifted trading zeal from brokers and financial specialists over the globe.

To learn more about Bitcoin and Red Star Forex, click on www.learnbitcoinanalysis.com. Get expert guidance from the experts of the industry.