Two questions everyone needs to ask:

- Why there is movement in currencies?

- How can I earn profit from that movement?

Why there is movement in currencies?

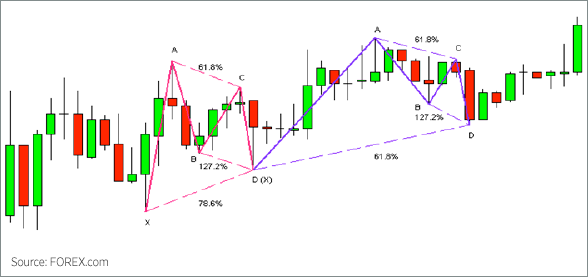

Currencies move for numerous reasons, ranging from central bank actions to weather disasters. “It is important to remember, though, that exchange rates are always expressed in pairs, so you are always measuring the pros and cons of two currencies.”

Economic announcements and other news events are the wild cards in Forex Market.

Economic releases can be thought of as real-time reports that give investors a glimpse into the underlying performance of the nation’s economy. These reports are usually published periodically by governmental agencies or private organizations. Although there are numerous policies and factors that can affect a country’s performance, the factors that are directly measurable are included in economic reports. Please visit www.learnforexanalysis.com for any information and support. The economic releases include various factors which play an important role in the movement in currencies such as:

- Gross Domestic Product: GDP is one of the most-watched metrics in forex trading because it is a clear indicator as to whether an economy is growing or shrinking and how much it is changing relative to the opinion of analysts.

- Non-farm payrolls: When reports suggest that non-farm payrolls are improving and strong, it can be interpreted to mean that the companies are growing and that newly-hired employees have money to spend, which will, in turn, fuel broad economic growth.Growing workforce and a strong economy will often lead to a strengthening currency.

- Purchasing Managers’ Index

How Can I earn profits from that movement?

Learning about forex is integral to a trader’s success in the forex markets. While the majority of learning comes from live trading and experience, a trader should learn everything possible about the forex markets, including the geopolitical and economic factors that affect a trader’s preferred currencies. Once you come to know that what factors behaviour matters in the movement of currencies, then accordingly you can start trades and make investments which could help you in making a profit.

Forex trading, simply, is exchanging one currency for another. Most are traded against the dollar. Other highly traded currencies are the euro, pound, yen, Swiss franc and Australian dollar.

The first currency quoted in a currency pair on forex is called base currency, which is generally the domestic currency. The second currency is called the quote currency and is typically the foreign currency.

For example, if you were trading in rupee-dollar, the rupee would be the base currency and dollar the quote currency. The price shows how much quote currency is needed to get one unit of the base currency.

The profit or loss in trade is expressed in the quote currency, as the currency pair price is given in it.

Spread: Each trade has two prices – bid and ask. The bid price is the rate at which the broker buys and you get on selling. The ask price is the offer price at which the broker sells and you pay to buy. The difference between the bid and ask price is the spread (broker’s profit).

Typically, a lower spread is better for traders, as it gives a higher profit.

Leverage and margin: In case of a small investor, if the price moves up by one per cent, you will earn more than your broker. It’s not a great deal for you; worse for your broker.

Margin call: On opening a trading position, you can designate a part of your capital as collateral on your margin, which will be set aside and protected.

Some losses are inevitable for any trader. However, the key is to limit losses by using stop-loss and controlling risk. If you set a limit order, you would have realised the potential profit without having to monitor the trade closely.

You can start with analysis, fundamental and technical. Skill to anticipate can be honed only by experience over a period of time.

Get in touch with the top traders in the world, visit www.topforextrader.com

With thanks! Valuable information!

With thanks! Valuable information!

I conceive this web site has got some real good information for everyone

Thanks wwww.sibyvarghese.com

Awesome! Its in fact amazing paragraph, I have got much clear idea regarding from this piece from http://www.learnforexanalysis.com