Weak shorts allude to dealers or speculators who hold a short position in a stock or other money related resource who will finish it off at the primary sign of value quality. Weak shorts are ordinarily speculators with restricted money related limit, which may block them from going for broke on a solitary short position. A Weak short will by and large have a tight stop-loss arrange set up on the short position to top the loss on the short exchange body of evidence it conflicts with the trader. Weak shorts are thoughtfully like Weak aches, yet they utilize long positions.

Weak shorts will probably be done by retail dealers as opposed to institutional speculators since their monetary limit is constrained. All things considered, even institutional speculators may wind up in the weak shorts camp on the off chance that they are fiscally extended and can’t bear to confer more funding to an exchange.

The nearness of weak shorts may heighten instability in a stock or other resource since they will be slanted to leave their short positions if the stock hints at fortifying. Such short concealing may drive the stock cost quickly, which may constrain different traders with short positions to close them because of a paranoid fear of being gotten in a short crush.

In this manner, if the stock starts to debilitate and again looks helpless, the frail shorts may reestablish their short positions. Weak shorts might be obliged by the accessibility of capital yet may even now have a high level of conviction in their short thought. Overwhelming shorting action would bother the stock’s shortcoming, driving its cost down rapidly, a trading design that could prompt uplifted stock unpredictability.

METHODOLOGY OF WEAK SHORTS

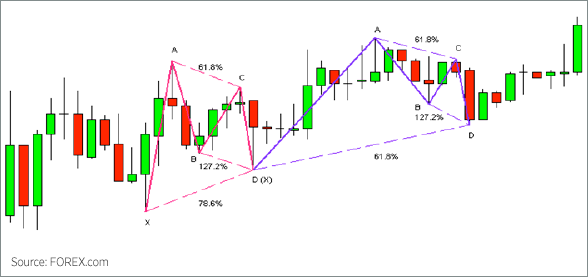

Brokers regularly search for stocks with overwhelming short intrigue, which is utilized as a contrarian marker to distinguish stocks that might be ready to climb on a short press. Stocks that are vigorously shorted essentially by retail financial specialists, i.e. Weak shorts, might be preferable short-press hopefuls over those where the short positions are for the most part held by foundations with profound pockets, for example, flexible investments.

While short enthusiasm for a stock is given on a combined premise and isn’t classified as retail or institutional, one approach to recognize retail short intrigue is by utilizing trading programming that shows real holders of the stock and square trade. A stock with (a) negligible institutional property, (b) few square trade and (c) huge short intrigue is probably going to be unified with a lopsided number of weak shorts.