WHAT IS THE BEARISH GARTLEY PATTERN?

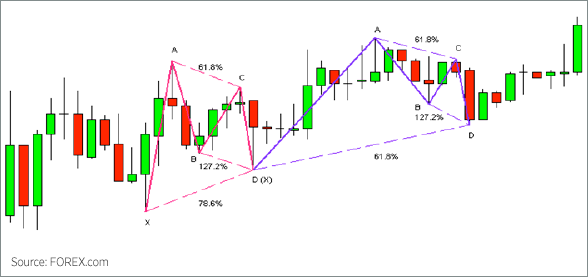

The Bearish Gartley Pattern was first presented in 1935 by trader H.M. Gartley in his book, “Benefits in the Stock Market.” It contains a bearish ABCD design gone before by a noteworthy high or low (point X). It is a visual, geometric value/time design contained 4 back to back value swings, or patterns it would appear that a “W” on value diagram. It is the main pointer that figures out where and when to enter short (offer/sell) position or exit along (purchase) position.

IMPORTANCE OF BEARISH GARTLEY PATTERN

The Bearish Gartley Pattern helps in recognizing the higher likelihood trading openings in any market (forex, stocks, fates, and so forth.), on any time allotment (intraday, swing, position). It reflects assembly of Fibonacci retracement and augmentation levels at point D proposing a more grounded level of obstruction, in this way higher likelihood for advertising inversion. X-to-An in a perfect world moves toward the general pattern, in which case the move from A-to-D mirrors a transient revision of set up downtrend. X-to-An in a perfect world moves toward the general pattern, in which case the move from A-to-D mirrors a fleeting adjustment of setting up downtrend. It may likewise give a more ideal hazard versus remunerate proportion, particularly when exchanging with the general pattern.

HOW TO DISCOVER THE BEARISH GARTLEY PATTERN?

Each defining moment (X, A, B, C, and D) speaks to a huge high or huge low on a value outline. These defining moments characterize the four back to back value swings, or patterns, which make up every one of the four example “legs.” These are alluded to as the XA leg, AB leg, the BC leg, and the CD leg.

CONCLUSION

The Bearish Gartley Pattern is a retracement design that happens when a pattern briefly inverts heading before proceeding on its course. It incorporates the AB=CD design in its structure and allows you to go long (bullish Gartley) or short (bearish Gartley) at the point where the example finishes and the pattern resumes. It depends on Fibonacci levels, which decide how far cost backtracks or stretches out amid the examples arrangement – MetaTrader 4 can naturally add these levels to your diagram. To exchange utilizing the Gartley design, put in your purchase request at the point where the C-D leg accomplishes a 78.6% retracement of the X-A leg. Setting your stop misfortune simply under point X. Drawing another Fibonacci retracement from point A-D of the finished example and take benefit at the point where the cost will have remembered 61.8% of the separation between A-D.

To learn more about Red Star Forex or the Bearish Gartley Pattern, click on www.learnforexanalysis.com. Get expert guidance from the experts of the industry.

Get in touch with Mr Siby Varghese to succeed in the Forex market.